- Call: 0203 427 3507

- Email: innovation@clustre.net

Covid-19 has created a global health crisis and the associated lockdowns, all around the world, have triggered both a huge shock to the global economy and a sudden and dramatic fall in global emissions.

As we start to come out of this crisis, there is a clear imperative to create a better, more resilient global economy. To build back better. So, as companies develop their plans for recovery, how should they prioritise the challenge of climate change?

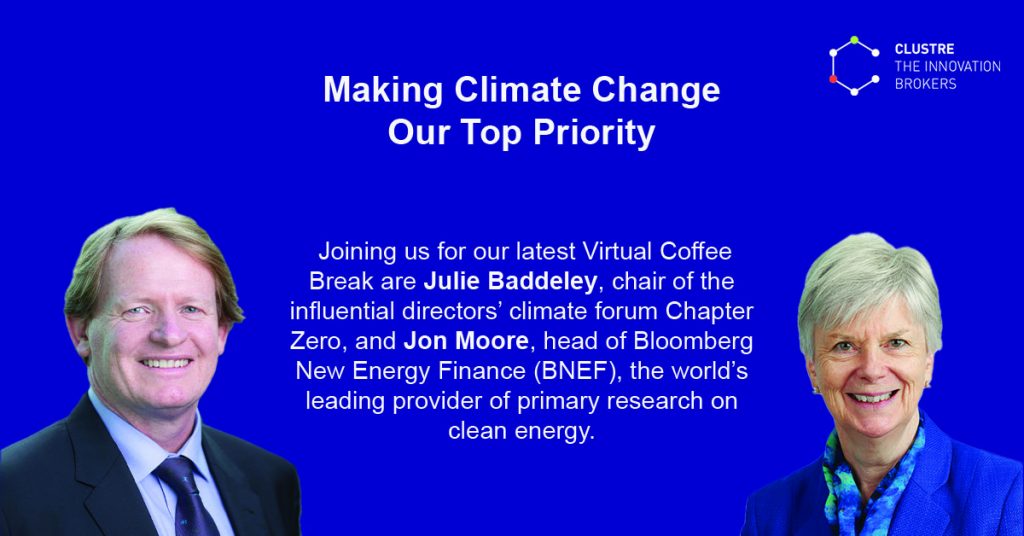

To answer this question and lead the discussion at this morning’s Virtual Coffee Break, we were delighted to welcome Julie Baddeley, chair of the influential directors’ climate forum Chapter Zero, and Jon Moore, head of Bloomberg New Energy Finance (BNEF), the world’s leading provider of primary research on clean energy.

Jon started the call by presenting highlights from BNEF’s Executive Factbook which covers the key decarbonisation facts in each sector: power, transport, buildings and industry, commodities, food and agriculture, and capital. These sectors pretty much account for 100% of global emissions and there are cross-cutting technologies, such as digital, hydrogen, biofuels and carbon capture, which will play a role in the transition of each of them.

We are all seeing the impact of global warming on temperature and weather, with more extreme weather events and increasing financial and economic consequences. The existence of global warming, and our role in driving it, are no longer up for debate – the question now is what do we need to do to limit it and mitigate its impact?

The October 2018 IPCC report remains the most authoritative summary of the challenge and, in their own words, this will require “systems transitions unprecedented in terms of scale”.

Power has been in the spotlight for the longest time and there has been a dramatic decrease in the costs of renewable energy. Wind and solar power now compete with fossil fuels and two-thirds of the world’s population live in areas where renewables are the cheapest source of new power.

Transport has also seen a great deal of progress, with perhaps the biggest opportunity in the growth in electric vehicles – the global electric passenger vehicle fleet now exceeds 7m (with China representing more than 50% of the market). Shipping and aviation present longer-term challenges, with the focus currently on alternative fuels and lightweight fuels.

The industry and buildings sectors are perhaps the hardest to abate, especially iron and steel, cement and chemicals, all of which are heavily reliant on coal, either as a feedstock or for generation of heat. The most promising new technology here is the use of hydrogen. This is not yet cost competitive but could be by 2030, with significant investment and policy support, and very much so by 2050.

Within industry, systemic gains will come from the transition to a circular economy, focused on longevity, reuse and recyclability. This represents a more sustainable solution than the “extract-make-use-dispose” approach to materials. For example, aluminium is extremely energy intensive to make, but requires only 5% of that energy to recycle.

In the food and agriculture sector, global beef consumption has peaked or is close to peaking. But decarbonisation is not the only driver of the transition here. Consumer pressures, for alternative sources of protein and more sustainable packaging, are also driving change. Much more so in fact than government regulation.

And finally, in capital markets, there is an increasing focus on the transition to a cleaner economy. This is now a major factor for investors; companies and institutions have raised more the $1 trillion of sustainable debt in the last decade. Sustainable finance (green bonds, sustainability linked loans etc.) creates options for companies to use debt for specific sustainable use of proceeds.

These large-scale transitions present many opportunities, sector-by-sector, for policy and capital to create jobs and make progress on pollution and climate change.

On the immediate horizon, these include: the digital infrastructure for remote working, micro-mobility services (e.g. electric scooters), electric vehicle charging infrastructure, recycling infrastructure, green finance, renewable energy auctions etc.

Longer term, there is even greater potential in: hydrogen for transport, hydrogen for industry, lightweight fuels for aviation and shipping, cleaner fuels for industrial heat, clean power transmission and distribution etc.

With Jon having set the scene, Julie explained the role of Chapter Zero in galvanising the network of non-executive directors and chairs of UK listed companies to put climate change at the top of the corporate agenda.

The simple truth is, we have a fixed carbon budget that we must stay within, if we are not to overshoot the limit of a 1.5 degree increase in global temperatures. To achieve this, we must halve our emissions by 2030. Our current trajectory is for an increase of 4 degrees or more!

This is much more urgent than people are recognising. It’s the biggest transformation challenge any of us have seen. The challenge is both to adapt and build resilience, to withstand the impacts of climate change that will occur anyway, and to develop the plan to get us to net zero emissions by 2050. It will require huge amounts of innovation and massive willpower. The technologies are there. The question is, will we use them?

We need to look at whole supply chains and business models in every sector. We need to invest in the future and put our capital in the right places. If the boards of our major companies are sceptical, not on board or not aware, then it won’t happen. ((the point about boards not talking about it was referring back to 18 months ago. I would leave it out))

Chapter Zero was launched a year ago and is part of the World Economic Forum’s Climate Governance Initiative. Its goal is to promote the conversation in the boardrooms of the UK’s major companies, by leveraging a network of chairs and non-executive directors, who make up more than 50% of all board seats. There are 920 members today and growing.

Chapter Zero provides authoritative, board-oriented toolkits, that are free to download, and which are being used to educate board members and create a receptive audience in the boardroom for the change that needs to happen (analogous to the awareness created around cyber-security).

Consumers and regulators will not drive change quickly enough – the lead has to come from business. Consumers understand the challenge and talk a good game, but do not follow-through with their actual spending. Government regulation is important, not least to create a level playing field and provide some measure of certainty against which to plan, but regulation alone will not address the scale of the challenge. Industry must take the initiative.

The UK’s Chapter Zero is just one of several networks around the world, all falling under the same World Economic Forum mandate, and the UK model is being adopted in several of these other countries.

How do we get people to focus on climate change in light of the Covid-19 and where do we need to innovate?

Is the Chapter Zero network being heard?

If the UK is going to meet its targets, won’t shipping and airlines need to reduce their capacity?

How can companies use lessons learned from Covid-19 to battle climate change?

Have we given up on government intervention and decided we need to do this ourselves?

Has someone modelled what the steady state net-zero economy looks like at the sector level?

There is a risk we slide back to the “old normal” – how do we influence each other towards a better “new normal”?

Governments tend to be short term in their outlook – how will they take the longer-term view needed to combat climate change?

The virtual coffee break concluded with a commitment from everyone to play their part in helping to spread the word and get climate firmly and squarely on everyone’s agenda.

Please visit www.clustre.net/category/events/ for details and to register for our future events.