- Call: 0203 427 3507

- Email: innovation@clustre.net

There has been a flurry of new ‘C’ level job titles in recent months and years. We’ve had the Chief Digital Officer (CDO), the Chief Data Officer (also confusingly abbreviated to CDO) and now we see the emergence of the Chief Customer Officer (or CCO).

Jaded cynics are quick to accuse management of creating ‘jobs for the boys’. And, in truth, this may be happening because modern management is now so full of ‘Chiefs’ that they’re starting to trip over each.

For example, in a recent article, I weighed into this debate by questioning the need for an independent Chief Digital Officer – a role that already fell within the broad remit of the CIO. To me, this seemed an unnecessary duplication of responsibilities and a potential recipe for chaos.

However, let me be clear, the position of Chief Customer Officer is a notable exception. I have no hesitation in endorsing this appointment because it is definitely not an artifice or a sinecure. When a CCO reports directly to the CEO, this is one of the most valuable roles in senior management.

Let me explain why…

Lost sight of the customer’s perspective

Some traditional, long-established organisations have become so diversified and complex that they have totally lost sight of the customer’s perspective. In an attempt to sharpen their consumer focus, many have invested heavily in CRM specialists, CEM consultants, customer empathy experts and a raft of other external ‘gurus’. Very often, though, this succeeds only in placing yet another barrier between companies and their customers.

Some traditional, long-established organisations have become so diversified and complex that they have totally lost sight of the customer’s perspective. In an attempt to sharpen their consumer focus, many have invested heavily in CRM specialists, CEM consultants, customer empathy experts and a raft of other external ‘gurus’. Very often, though, this succeeds only in placing yet another barrier between companies and their customers.

Ultimately, the only way to make any serious progress is to tackle the problem internally. To create an in-house customer advocate. A senior executive who is not only the internal voice of the customer but also their agent of change. The CCO.

Let’s take a close look to see why this role is so vital. And let’s take the typical high street bank as a practical example…

One part of a bank runs the branch network. Another runs the website and yet another takes responsibility for an increasing number of mobile apps for customers. Then there’s an IT department to look after the ATM network. And, to further confuse things, there’s probably a customer ‘Help’ desk in a distant, off-shore call centre.

Now try getting all of these disparate elements to work in perfect harmony. It’s a nightmare. When you attempt to resolve a simple problem, it invariably becomes a frustrating marathon. Why? Because each person’s powers are strictly confined and defined…. bank staff deal in fragments of the solution… they rarely see the big picture… so there’s no joined-up response… no holistic service. That’s why you get passed from pillar to post.

Of course there is one person who does see the whole picture. One person empowered to weave all of these loose threads together. Unfortunately, the CEO is rather busy right now!

Three further dimensions of difficulty

And if you think this problem is confined to banks, think again. The very same issues and endemic problems can be found in major retailers, utility companies and many government departments. And just to add to the problem, there are three further dimensions of difficulty that you have to factor into the equation… problems that have nothing to do with products, technology or channel proliferation. I’m talking about individualism, ‘distance’ and sheer personal terror. Let me explain.

Individualism.

We live in world where freedom of choice is a fundamental consumer right. But, not so very long ago, companies called the shots and consumers meekly conformed. Henry Ford famously declared that you could buy his mass-produced Model T “in any colour you like providing it’s black”. Today, Ford will sell you a Fiesta in any colour from ‘Frozen White’ to ‘Hot Magenta’, ‘Candy Blue’ to ‘Moondust Silver’, ‘Copper Pulse’ to ‘Panther Black’. The day of the compliant customer is long gone.

But watch this space because the age of mass customisation is about to be superseded by yet another phenomenon: mass personalisation. The relentless obsession with self-expression is unstoppable.

Distance.

Technology can be empowering, emancipating and enlightening – but it can also be dangerously isolating. The emergence of more and more digital channels has driven management further and further from their customers. Executives have lost contact with consumers. The old, instinctive understanding that comes from keeping your finger on the pulse of shop-floor opinion has gone. Indeed, I know of one company that expressly forbids its Head Office staff from even reaching out to customers. With ludicrously misguided logic, these managers now rely on consumer surveys and focus groups… polling devices which, as our latest UK election has proved, are gravely misleading. Distance is dangerous.

Terror.

The power of social media has changed the way we communicate. The screen and keyboard have become our preferred channel for human contact. Study a group of teenagers at a bus stop and they won’t be talking to each other; their fingers and thumbs will be far too busy connecting with Facebook. And you can translate this same remote behaviour to senior levels of business. Management now seems strangely reluctant – almost scared – to interact with customers. This true story proves that point…

One of my contacts is the CEO of a major retail group. Concerned that his management team was becoming increasingly disconnected from its customers, he mandated that every senior executive should spend at least a day every week on the shop floor, serving customers. This initiative almost induced a collective coronary. One young executive was so paralysed by the prospect of human contact that he actually fainted.

It will take more than smelling salts to rectify this consumer disconnect – it will take the concerted efforts of talented CCOs. The rapid emergence of new and increasingly customer-friendly digital enterprises is a very real threat to traditional businesses. They could easily lose their customer base, en masse, if they don’t get closer and become more empathetic with the one thing that keeps them in business – their customers.

The model approach

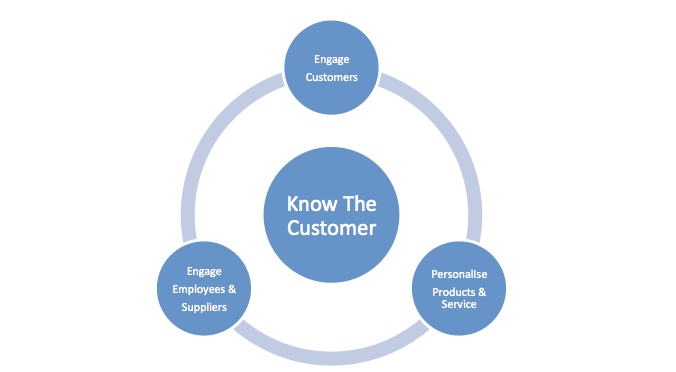

We use the model below to summarise the key process to becoming more customer-centric. To our mind, this is one chart every CCO should pin on their wall – it’s a proven route map for anyone embarking on a customer-centric journey. In a future article, I plan to discuss this chart in greater depth but, right now, I want to draw your attention to the most important component… the central message at the very heart of this chart: ‘Know the Customer’.

Understanding what your individual customers need, want and value – and, just as importantly, what they don’t need and desire – is key to delivering customer centricity. Get it right and you will deliver a customer experience that’s certain to generate repeat business and positive word of mouth referrals. Get it wrong and you could soon be out of business.

Understanding what your individual customers need, want and value – and, just as importantly, what they don’t need and desire – is key to delivering customer centricity. Get it right and you will deliver a customer experience that’s certain to generate repeat business and positive word of mouth referrals. Get it wrong and you could soon be out of business.

Some say that the route to understanding is via Big Data. And there’s no doubt that forensic analysis of consumer behaviour can be revealing. But its value is limited to the past. It cannot tell you what people are buying right now or what they are very likely to buy in the future. Let me put this in perspective. Supermarkets are some of the most voracious consumers of historical data. However, Big Data hasn’t exactly halted the recent catastrophic slump in their sales. Clearly, history is not giving us the intelligence we need – but, curiously, cutting-edge technology is now coming to our rescue…

Technology has undoubtedly exacerbated the isolation problems of large organisations; however, it is now helping to foster a new sense of understanding by closing the chasm between customers and senior management. And it is doing so in a really clever way…

For example, there is a new breed of innovator that exploits the power of smartphones to capture hugely revealing, real time customer insights. It uses the video selfie to engage with a pre-selected group of consumers – capturing their experiences at the very point of sale. Sentiments and semantic themes can be analysed, body language can be studied and advanced algorithms can identify key learning points. Most revealing of all, this technology is bringing the real ‘Voice of the Customer’ into the Boardroom.

To me, that is a vital step forward. Because anything that breaks down the isolation of senior management has got to be good for business. It’s not necessarily a substitute for pressing the flesh with real customers but it will enable senior management to capture the pulse of their customers rapidly without leaving the comfort of their head office suite.