- Call: 0203 427 3507

- Email: innovation@clustre.net

Once upon a time in a living room far, far away, if you wanted to watch something other than the terrestrial channels, and you weren’t one of the lucky few with cable, off you set to Blockbusters. Then, as legend tells, the Internet in general and specifically the Netflix Deathstar destroyed this much-loved institution…

Except it didn’t.

As a number of recent articles have noted, Blockbuster went bust itself, with a little help from Viacom (saddling it with $905m in debt). Aggressive pricing on DVDs and the rise of Netflix didn’t help but they didn’t kill it. Like most simplistic explanations for things it’s just wrong and leaves out many important, challenging and complicated factors. Read Ben Unglesbee’s excellent piece in Retail Drive on what actually sank Blockbuster.

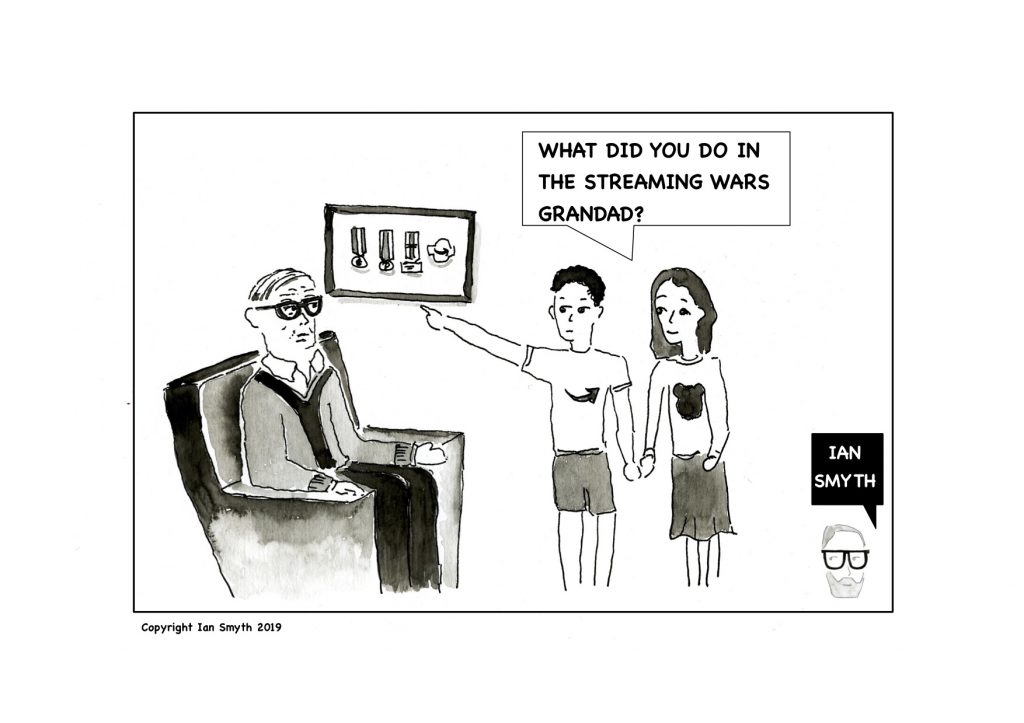

Streaming wars?

Streaming Video On Demand (SVOD) and specifically the subscription streaming services offered by Netflix and Amazon Prime are entering an era of increased competition, with the launch of Disney+, Apple TV+, HBO Max , BritBox (plus the many smaller, niche-oriented streaming services, like The Criterion Channel or BFI player). Much of the general media and trade news coverage has lumped discussion of this rising competition under the banner of ‘streaming wars’. However, headlines that shout about who will be the ‘winner’ are completely missing the point.

It’s about the strategy, stupid.

It’s not a war because many of the different players involved are not directly competing with each other – they are simply pursuing different strategies. If we look at the main players who are being set against each other then their divergent strategies become clear.

Why Disney+ and Apple TV+ won’t kill Netflix

With 159m subscribers globally. Netflix is the market leader with its first mover advantage. Disney+ is not an attempt to take on or kill Netflix – it’s designed to be consumed alongside Netflix (its inventory and its pricing suggest this and are a reflection of the broader Disney children and families focus).

The same is true for Apple TV+ – this is an obvious adjunct to Apple customers’ existing Apple Music and iCloud subscriptions. Their content enhances the value of the Apple products and these provide a locked-in distribution channel of over 1.4bn devices. In this respect, Apple has a clear advantage over both Netflix and Disney whose key strategic weakness is the lack of control over distribution. This has led some commentators to predict that either Disney or Netflix will swoop for Roku, who’s share price, despite some recent turbulence, has shown strong growth.

What are Amazon’s ambitions for Prime?

I must admit I was initially confused by the Prime offering – free delivery, TV and Music. Sure I wanted free delivery but did I want the other services? Well the answer, , was yes I did want the TV (after a reported $6bn spend on original content). I’m still ambivalent about the music as an Apple loyalist but Amazon Music has over 32m music subscribers and over 100m Prime subscribers.

But the Prime strategy is all about tying subscribers into the Amazon online retail service and the recent purchase of the Premier League rights package around two days in December and the traditional Boxing Day fixtures demonstrates this. These rights purchases also create the potential for Amazon to add further premium subscriptions (like Music) on top of the basic Prime package.

Another interesting opportunity that opens up for Amazon is becoming the main marketplace for SVOD. Their Prime subscription includes a number of programmes, many on a time-limited basis. But when you want a programme not included in Prime you are offered an alternative supplier. It wouldn’t take a huge leap to see this as another space that Amazon could dominate. Why launch your own SVOD operation, with all the associated overheads, if you could just retail through Amazon?

Increased competition is not driven by innovation.

Netflix and Amazon have been innovators in the SVOD space. The other entrants to this market are not innovating but enhancing their product and service offerings. Netflix has led innovation in this space, initially as first mover and increasingly with its use of AI for content discovery and consumption. Amazon continues to deliver almost continuous innovation as a business. Many businesses have identified the importance of sports rights to drive customer take up but Amazon saw sports rights not just as a premium offer but also as a (online) retail sales driver. And the strategy appears to be working with first two days of Premiership coverage resulting in the two biggest Prime sign-up days in UK history. Focused innovation means that both Netflix and Amazon will continue to be significant players despite increased competition.

There will be many ‘winners’ but there’s also trouble ahead for some…

Rather than a single ‘winner’ the market will see a more complex mix of increasingly bespoke customer offerings. Consumers have demonstrated that they are prepared to pay for more than one streaming servicewith over 40% of the market having two already. It’s not much of stretch to see how three services might become the norm for many consumers. In my household we already have Netflix and Amazon Prime but Disney+ will be required once it launches in the UK, probably in the first quarter of next year.

Companies like Disney will also gain another advantage through their SVOD offering – data analytics. The consumption data will increasingly help them refine their films and amusement parks experience and combining all this data will undoubtedly enable them to leverage greater value from their core base as well as recruiting more cost effectively.

Services like Spotify may find themselves in trouble:

Another area where there could be challenges is for advertisers who increasingly find their target market consuming content behind a pay wall they can’t breach. This, of course, will create opportunities for more innovative media planning around product placement and sponsorship but many of us are happy to pay a premium to reduce our exposure to advertising.

Netflix Co-founder, Entrepreneur, Investor, and Advisor Marc Randolph gave an enlightening answer on Quora recently in which he said:

“Yes, there will be losers and small or marginal players will struggle to bring on sufficient subscribers to subsidize attractive content offerings. But I think it’s a false choice to think that the emergence of a new service means that one of the larger established players will automatically fade away.

But as you’re trying to handicap the win/place/show of the streaming races, I don’t think it is informative to look at current offerings or subscriber projections. Instead it’s helpful to look at the fundamental behaviours – the cultures – of the competitors.

Netflix are a company that – from the very beginning – has been solely focused. Right now, it’s all about streaming. And Netflix has never hesitated to narrow their focus when they felt that a legacy business was in any way slowing down their ability to put everything into whatever the future might hold.

Compare that to some of the other streaming players: Apple – who is building hardware, writing software, and running retail stores. Amazon: E-commerce, cloud, retail, etc. Disney: with their theme parks and cruise ships. None of them have the focus that Netflix does.

Does this alone guarantee that Netflix will continue to thrive? Or course not, but it’s one more reason why I’m confident in their ability to stay in the race and always be someone to watch. When I short Netflix will be the day they announce a new cell phone or the Netflix theme park”

The key point here is that of culture, as we’ve seen many times in the past. When organisations lose their cultural way, such as Starbucks or indeed Apple for a period, they start to fail. Netflix has strong and consistent leadership that has retained focus and I can’t see this changing with the increased competition.

So, let’s stop talking about the ‘streaming wars’ and see the real picture of what’s happening in this highly dynamic space: it’s more about culture and strategy and how these combine to meet diverse needs of customers. Each player will stand or fall as much on their ability to meet these needs as on their ability to beat the competition.

Ian Smyth is the Co-Marketing Director of Clustre – The Innovation Brokers